We had presented our bullish case on Australian listed rare-earths developer Meteoric Resources two months ago. Although a very small cap now, its key project has world class Tier 1 potential in Brazil, with the most sought-after rare-earths deposit type, and with grades >3x that of ionic clays in China. The shares are up 60% in a month - but from near bottom. It had been punished since 2023 from weaker NDPR prices and more recently, since February this year, by its anticipated exit from the ASX 300 which happened late March.

Since our last report, the flagship resource size effectively doubled to a globally significant 1.5Bt and with an expanded high-grade zone. The new resource base entails a c125y life on our estimates, something the market misses. And the resource could grow a lot more, the company argues. Indeed, in a recent interview, the chairman suggested it could grow by >5x over time. While adding resources to an already long-life asset does little to the NPV calculation today, it warrants a higher NAV multiple to factor in the NPV-reset effect.

Shares still discounting unsustainably low NDPR prices

Despite the share price increase over the past month, we calculate that the stock today discounts cUSD57k/t Neodymium prices. This is very close to our estimate of the price needed by Chinese incumbent producers to make their cost of capital today (USD56k) – and so, to floor prices. This was reemphasized in early Q2 last year when the Neodymium price quickly bounced after hitting this level (see chart). It should be noted that the floor price could shift meaningfully higher in the future if more stringent environmental considerations are adopted in China, which we view as likely.

Neodymium prices (USD/kg)

Source: Daily Metal Price

> 6x fair value upside at incentive price

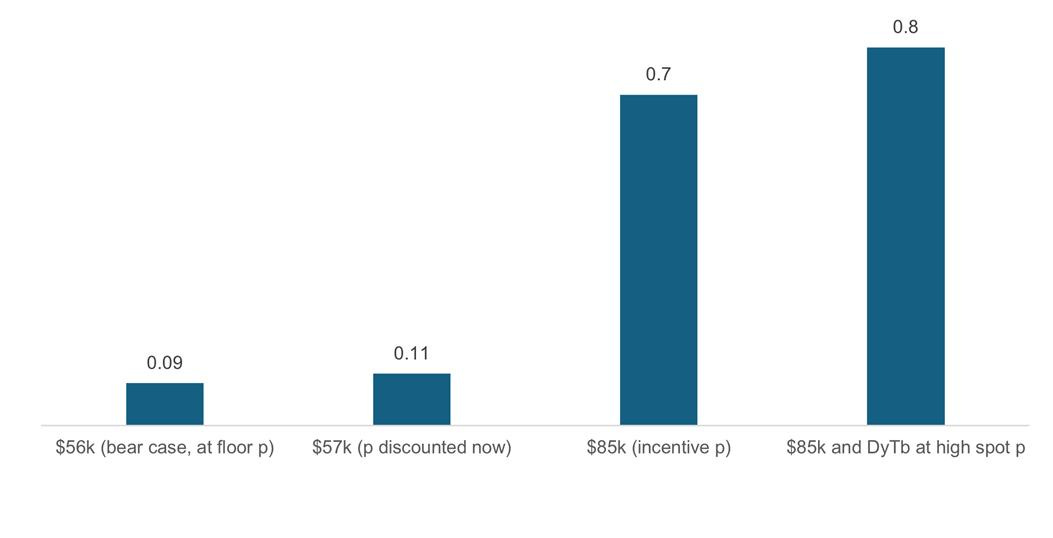

Neodymium is currently trading at cUSD75k/t, so 30% higher than what is discounted in the shares today. But the incentive price is higher still, at cUSD85k/t on our estimates. At the incentive price and assuming a conservative 1.2x NAV multiple for such a unique asset, the shares would be worth cAUD0.7/sh or 6x higher.

And this estimate does not touch on any US/China trade tension risks. So far, light rare-earths have been spared, but this might change. The project is predominantly light rare-earths based but it does have DyTb. At these current high prices, DyTb would amount to c18% of revenues. Were we to factor in high spot DyTb prices to our base case, all else equal, the fair value would rise to cAUD0.8/sh indicating 7x share price upside.

We summarize our valuations below.

Meteoric R fair values at various Neodymium prices (USD/t), AUD/sh

Source: Asymmetric Research

Our key modelling assumptions include:

Production beginning in 2028

Key scoping study operational metrics up to year 20

But extending to a 125y asset life

WACC 11%

Catalysts / project timeline

PFS around July 2025, which is expected to show improved economics vs the scoping study on a bigger resource and incorporation of high-grade material. Work will then immediately start on the DFS

Environmental permit early Q2 2026

Construction start mid-2026, with around one year construction time, the company argues

Key risks to our bull thesis include politics and geopolitics in Brazil and whether China has an intention and is ultimately able to keep NDPR prices low for longer. The shares are technically overbought here, but the fundamentals are clearly getting better. Finally, we believe that the company will likely at some point need some money to build a pilot plant. In October last year, the project was included in the Brazil Climate and Ecological Transformation Investment Platform. Eyes on whether they can get access to preferential funding in Brazil for this.

***

These are our views only and not investment advice. We own shares in Meteoric Resources. We have not been paid by the company for this research nor has it seen it prior to publication.