Europe complacency bullish TTF

Recent developments on European natural gas policy hint at overconfidence and complacency by policymakers in our view.

The EU unveiled last week a phaseout plan for Russian gas imports. Notably, the proposal wrote: “Russian gas imports under new contracts will be prohibited as of 1 January 2026. Imports under existing short-term contracts will be stopped by 17 June 2026, except those for pipeline gas delivered to land-locked countries and linked to long-term contracts which will be allowed until the end of 2027. Imports under long-term contracts will be stopped by the end of 2027.”

Our understanding is that:

This will cut Russian gas imports into the EU in 2026 by c7Bcm vs 2025 (equivalent to c2% of annual demand), most of which in H2

The biggest hit will take place in 2027 when the remainder of Russian gas imports is phased out.

This text appears to suggest the Ukraine gas transit contract won’t be able to resume, and the Nord Stream pipelines won’t be able to be brought on.

The proposal still needs EU parliament approval and qualified majority backing at the EU council (55%).

To us, the TTF market looks tight this year, a bit looser next year as new US LNG comes in, and tight again and tighter still in 2027 as Russian gas fully phases. This assumes normal winters and zero impact from a worsening of the Iran conflict.

As to EU gas storage, we believe that at best, it closes the calendar year 2025 slightly below historical averages despite optimistically assuming sustained well-above average injections (and normal winter).

EU gas storage and projections, % full

Source: Asymmetric Research, AGSI

The risk is that big injections don’t hold up. Indeed, Europe chose to effectively relax the gas storage fill targets. While it still targets a 90% fill (between 1 October and 1 December), there is the possibility to deviate by up to 10 percentage points to 80%, if as Reuters writes, there are “difficult market conditions, such as indications of speculation hindering cost-effective storage filling”. Thankfully, this announcement is slightly more conservative than an earlier one which had envisaged a storage target of 83% full during that time, and the possibility to deviate by up to 8pp to 75% if supply disruptions or high demand persisted.

For reference, an 80% peak fill at the typical time assuming normal winter temperatures would take the calendar year end fill to 60% - towards the lower end of historical fill for that time of year. As a comparison, 2021 calendar year ended at 53% full and this was the start of the energy crisis in Europe which took TTF up into the triple digits. Instead, if Europe faced a continued cold winter, it could end the heating season at 2021 levels (30%), and a particularly cold snap like in 2013 would take it down to unchartered territory.

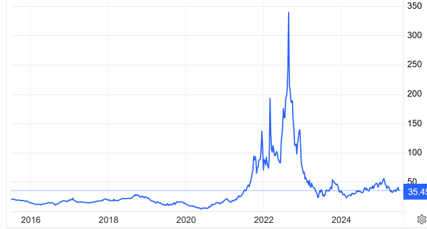

TTF price €/MWh, front month

Source: Trading Economics

All in all, if the phased Russian gas proposal discussed above goes through, then a European natural gas black-sky scenario vanishes in our view.

€35-40/MWh (USD12-13/MMbtu) likely becomes the new normal but with risks tilted to the upside. The winter 2027 contract at €30/MWh at time of writing is too low, we would argue.

Finally, looking at market positioning, financial funds net positioning on TTF is broadly consistent with where it has trended over the past couple of years, meaning there would be scope for TTF to run. The data below is pre-Iran war – there has been an uptick in last week’s release by +3pp, but that data was pre-US strikes so we suspect some give back in the next data release.

Financial funds net position on TTF as % of open interest – pre Iran war

Source: ICE - COT data

Volatile geopolitics

During his election campaign a year ago, Trump had argued he wanted to “stop wars… [he was] not looking to get involved in wars… wanted to bring peace…” and that under his leadership he would “bring back a world where peace is the norm”, and that he knew how to do it. He had also said that he would end the Ukraine war in 24 hours.

Fast forward to today, Russia has YTD continued to gain more territory in Ukraine with no real diplomatic progress; Israel continues its operations in Gaza; and the so-called ceasefire between Iran and Israel just announced by Trump is anything but guaranteed. In our view, there is high chance of re-escalation. Indeed, unlike prior episodes, this latter conflict which started mid-June, claimed many civilian lives - two dozen of Israeli and hundreds of Iranian deaths according to their respective media sources. Israel dealt a big blow to Iran’s senior military commanders, and Iran hit Israeli cities causing clear destruction. Finally, and critical, some reports are suggesting that Iran’s 60% enriched uranium wasn’t destroyed but rather moved ahead of the US strikes on the Iranian nuclear facilities and remains in Iranian possession somewhere else: calling into question the success of the US strikes and risking therefore renewed escalation in the future.

US gas prices near floor…

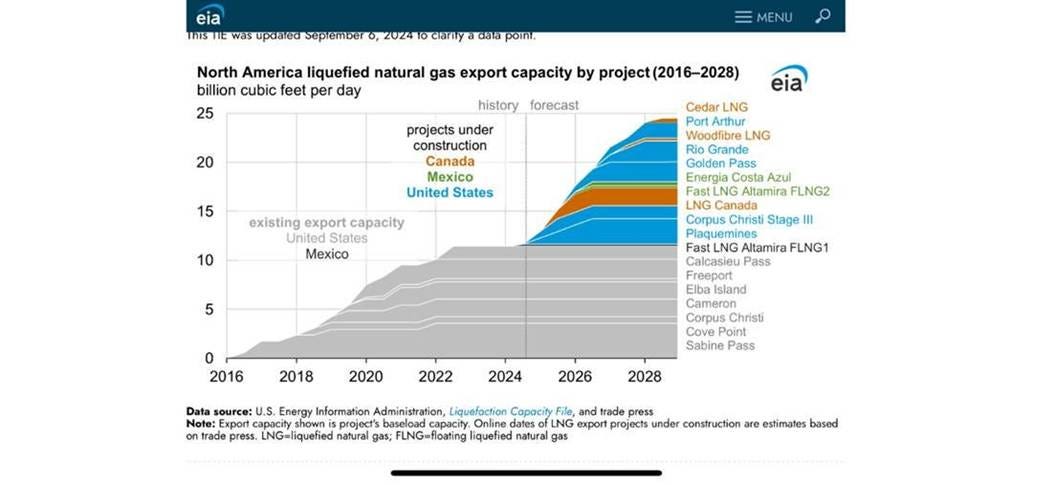

We see a USD 3.5-4/MMBtu as a reasonable floor for Henry Hub. It should be stressed that there is a significant c4Bcf/d of incremental US LNG capacity expected over the next 18m (>30%) which will be supportive of prices, in addition to the higher for longer European natural gas price environment we just discussed.

Furthermore, while the average breakeven price of existing LNG is at USD 4/MMBtu too, that of new projects is at USD 7/MMBtu according to EIA. That’s 60% higher than where Henry Hub futures are, further supportive of prices going forward.

LNG Breakeven costs, USD/MMBtu

Source: EIA

We remind below the key new and upcoming LNG projects:

Plaquemines 1 (US): 1.3bcf/d started operations in December 2024

Corpus Christi 3 (US): 1.3cf/d started operations in December 2024

LNG Canada (Canada): 1.8bcf/d, just started operations, needs to ramp up

Plaquemines 2 (US): 1.3bcf/d will start operations in September 2025

Golden Pass 1-3 (US): 0.7bcf/d each (for a total of 2bcf/d) will start operations late 2025 for 1, and mid 2026 for 2-3

Woodfibre (Canada): 0.3bcf/d will start operations in 2027

North American LNG projects, Bcf/d

Source: EIA

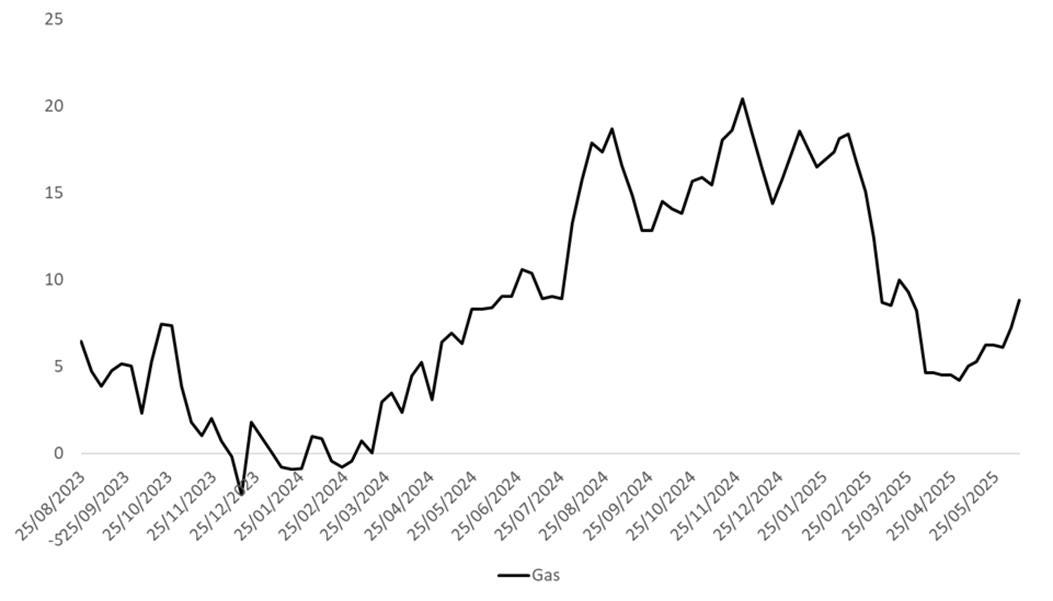

Canadian natural gas prices about to take off?

Canada’s AECO natural gas price is currently trading at around 55% of Henry Hub based on 2026 future prices and 1/5th of TTF. We think this is the year AECO finally takes off with the entry into operation of LNG Canada – which just started operating but still needs to ramp up. On our calculations, from 2026, the Canadian natural gas market surplus would have effectively been cut significantly as a result.

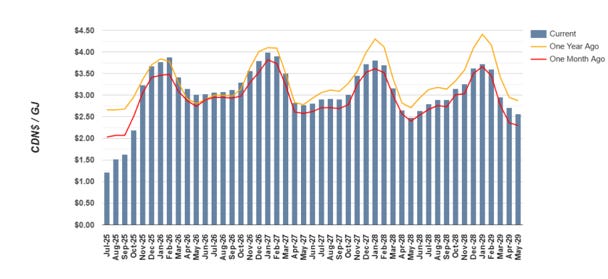

AECO prices, CAD/GJ

Source: Gas Alberta

Equities – Canadian natural gas plays are cheap

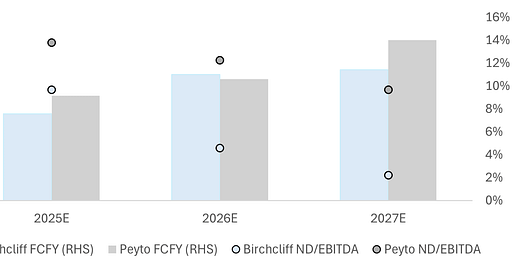

On the equities, we continue to like Canadian natural gas producers. We particularly like Birchcliff Energy and Peyto, which on our numbers present >75% fair value upside assuming an average realised price pre hedges of USD 3/MMbtu on average 2025-2027E, USD 65/bbl WTI and a 9% cost of capital.

They have good balance sheets and generate attractive 12% equity FCF yields on average 2025-27.

Birchcliff Energy and Peyto, Equity FCF yield and ND/EBITDA

Source: Asymmetric Research

***

These are our views only and not investment advice. We have not shared our report before publication with the companies mentioned, nor have we been paid by the companies.

Which companies own these LNG projects?

Thank you for your work!

Ukraine cut the remaining pipelines to Hungary and the Tchek republic in the last 4 months and stepped up attacks on the Russian shadow tanker fleet. At least 15 SBU attacks to vessels in port or in movement, mainly in the engineering compartments. And attacks on storage and refineries. I would rule out supply from Russia to Europe, at least one that is consistent and reliable.