Three more small-cap names to watch...

In this note, we add three small-cap stocks to our list of standout plays on natural resources, with appealing equity stories at arguably cheap valuations. These are ranked by market cap.

EMX Royalty (market cap cUSD350m)

EMX Royalty is a Canada and US listed royalty company. It has royalties on seven operating mines, including on the unique: (1) Zijin operated Timok copper-gold mine in Serbia (0.36% NSR royalty) which has vast resources of 18Mt of copper and 15Moz of gold (so far) including the new MG Zone discovery which remains open; and (2) the Lundin operated Caserones copper-molybdenum mine in Chile (0.83% NSR) with copper resources of 4Mt. We believe Timok has more than 50y of remaining life, and Caserones 25y+. While gold royalties make up c50% of revenues today, copper royalties make up around 65% of our estimate of the fair EV (rest being gold mainly), with Timok and Caserones accounting for more than 50%. The Gediktepe mine in Turkey in which EMX holds a big NSR on gold production is a key contributor to EMX revenues today, but it has limited residual life (2y on the 10% NSR).

Furthermore, EMX is also a royalty generator with superior geological technical expertise, providing exploration upside on more than 200 properties across fourteen countries. Royalty and streaming giant Franco Nevada holds a 6% stake in EMX and has a partnership with the company in which they jointly purchase new royalties sourced by EMX.

Valuation

EMX offers 80% share price upside on our Base case numbers, which factor in the following conservative assumptions:

Real prices of USD 4.5/lb copper, USD 3000/oz gold and USD 37/oz silver

Average cost of capital of c7%

1x NAV

Little value to the exploration package

Looking at it in another way, at the current share price and based on these assumptions, the market cap is entirely justified by the Timok and Caserones royalties on reported resources only, while all the other assets as well as exploration upside across, come for free.

The company has a good balance sheet and generates a FCF yield of c7% on average over the next three years, on our numbers. EMX already has a 5.4m (USD16m) buyback program this year equivalent to c4.5% of shares outstanding. All else equal, we think there is scope for them to increase capital distributions to USD 20m+ next year and after, offering a particularly attractive yield, while it also effectively heads towards a debt-free position in 2027.

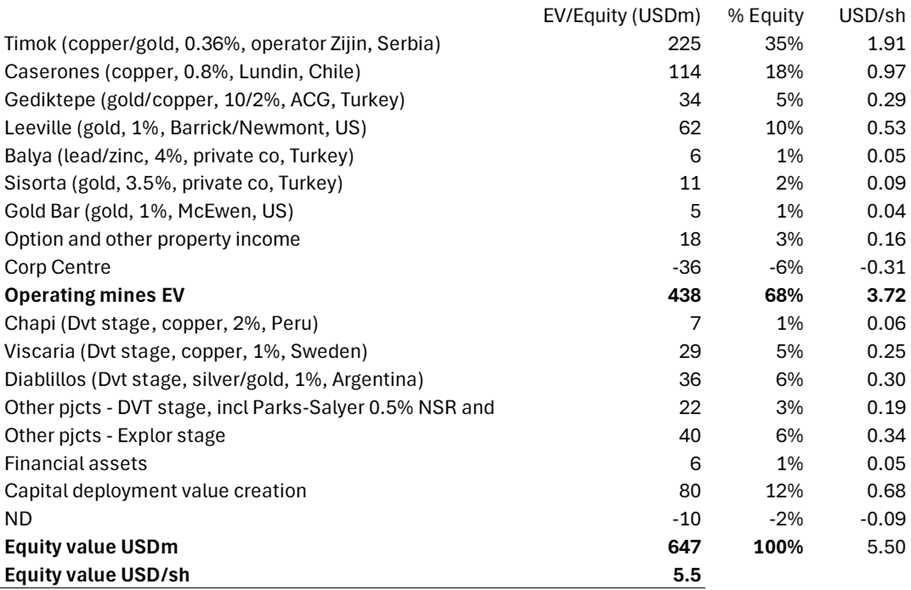

EMX – Our Base case sum of the parts valuation

Source: Asymmetric Research

The (big) bull case upside optionality could come from multiple expansion. Mid-sized precious metal royalty stocks trade at 1.5x NAV, while the biggest caps at close to 2x. Moving to 1.5x NAV multiple as the story develops and in a sustained commodity bull market would lift our equity fair value of EMX to USD8/sh for c160% upside.

Catalysts:

Royalty generation foremost from its large property package, and possibly royalty acquisitions.

Exploration results and resource growth at Timok (MG Zone) and Caserones. Also, Zijin is building a >$3bn block cave operation at Lower zone of Timok which is expected to be operational in 2028.

Generally, exploration results throughout.

Key risks:

Geopolitics particularly in Serbia and Chile; delays to start of lower zone production at Timok; delays to start of development stage projects (we have Chapi and Viscaria starting late 2026, Diabillos late 2027).

Bravo Mining (market cap cUSD300m)

Bravo Mining is a Canada listed PGM developer. It fully owns the Luanga PGM project in Brazil’s well -established mining Carajás Mineral Province. It had bought the project from Vale in 2022. PGMs tend to be mined in Russia and South Africa, so this asset provides an appealing alternative jurisdiction in our view. This is a 15Moz PdEq open-pittable deposit at a high grade of 2g/t, and open at depth. At current prices, the projects’ revenues would be c83% PGM, more than half of which being Palladium. c13% would be nickel, with gold currently accounting for a much smaller share.

Bravo released a PEA early July, with the economics coming meaningfully better than we had anticipated. To us, Luanga looks like a Tier 1 project. Initial capex of USD 500m is equivalent to sub 40% of our base case NPV.

Furthermore, it should be noted that last year, the company intercepted 1km away what it described as a High-Grade IOCG-Style Massive Sulphide copper gold mineralization – with big hits like 11.5m at 14% Cu and 3g/t. At the time, it had said this was likely unrelated to the Luanga deposit.

Valuation

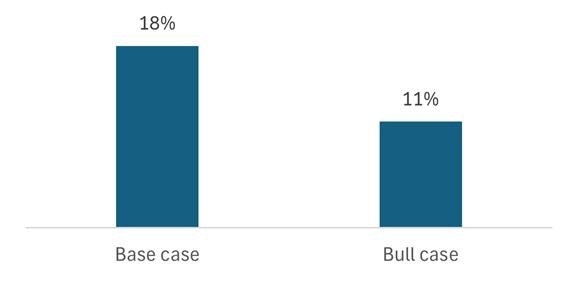

The stock trades on c18% P/NAV, on our Base case of spot commodity prices, a 10% cost of capital, 1x NAV and a project start in 2029. At our Bull case of incentive pricing for PGMs and nickel, the stock trades on a low 11% of fair value. These estimates do not assign any value to any possible IOCG discovery, which remains pure and potentially large upside optionality.

Bravo Mining – P/NAV

Source: Asymmetric Research

Catalysts:

Drilling of IOCG style mineralisation, with results expected in Q3 and Q4.

PGM commodity prices have rebounded this year. We would argue the Bravo share price has not accurately factored in the move higher.

Beginning PFS work for study to complete in 2026 and advance permitting (one critical permit, LP permit, was obtained in Q1 this year).

Key risks:

Geopolitics in Brazil; the commodity price environment (though this is a low-cost operation).

Saturn Metals (market cap cUSD130m)

Saturn Metals is an Australia listed gold developer. Its core asset is the wholly owned Apollo Hill project in Western Australia’s Eastern Goldfields, 650km northeast of Perth. This is a 2.2Moz gold project at 0.5g/t. While low grade, it is a bulk mining heap leachable resource, with low strip ratio (1.5x), and would use fully conventional processes. The company released at PEA on the project in summer 2023, with attractive first-hand economics (AISC USD 1200/oz, capex USD 200m as at PEA). It is currently advancing a PFS.

What’s key here, is that Dundee Corporation a company run by mining investing legend Jonathan Goodman holds an 18% stake in Saturn, equivalent to c11% of Dundee market cap. They have board representation at Saturn. It should be highlighted that Dundee’s technical due diligence is extremely thorough.

Valuation

Given the size of the resource and the initial economics, valuations of Saturn remain noticeably low in our opinion. We would attribute this to Australia being little accustomed to heap leach projects, even though they are widely used in other parts of the world like the US for example.

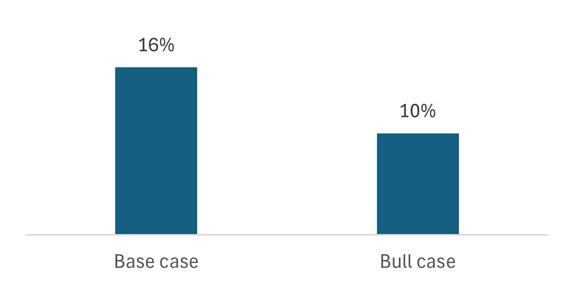

The stock currently trades at a low 16% P/NAV, assuming USD 3000/oz gold and 9% cost of capital. On a USD 3400/oz bull case and say a 1.3x NAV target multiple as the precious metals bull market establishes itself, it trades on only 10% of fair value.

Saturn Metals – P/NAV

Source: Asymmetric Research

Catalysts:

PFS due around November 2025, followed by DFS in 2026.

Regulatory approvals are scheduled for 2026, with construction planned to begin in 2027, and production starting the year after.

Recent drilling has intersected higher grade mineralisation at Apollo (Iris zone), potentially signalling a step change in the geological potential. Eyes on future exploration drilling here, which will go deeper (down to 300m, vs 100m tested so far).

Key risks:

Timely delivery of the above catalysts; gold price scenario (albeit to a lesser extent than many other gold projects given the very low-cost operation); raising the funds to build the project in region where heap leach operations have not been the norm, though we should stress the strong institutional backing in Saturn is a distinct advantage in this sense. Moreover, Saturn’s MD, Ian Bamborough previously worked from Newmont, which has extensive experience in heap leaching.

***

These are our views only and not investment advice. We own shares in each of the above companies. We have not been paid by the companies for this note nor have they seen it prior to publication.

Great picks to look into further, appreciate the insight.