Q1 production takes: CCJ clear beat, KAP ramp up consistent

Both groups reiterated guidance they set at FY 2024 results. We dig deeper.

Cameco (CCJ) delivered Tier 1 production around 7% ahead of the implied FY guidance trend. At 100%, and annualized, the production beat is equivalent to c+2Mlbs. But instead, the group stuck to its 36Mlbs production guidance (100%) for its two key assets, looking for a -1Mlbs production decline yoy in 2025 (-3% yoy).

At FY 2024, Kazatomprom (KAP) indicated it would likely reach the low end of its production guidance of 25-26.5kt. Q1 numbers are in fact tracking mid-way between the low and the mid-range of its 2025 annual guidance, we estimate. Continuing this trend would deliver 66Mlbs this year, equivalent to annual production growth of +6Mlbs yoy (+9% yoy), with the company indeed ramping up therefore.

Quarterly results can vary significantly, but for illustrative purpose, extrapolating the Q1 performance for the whole year would indicate in total a 3Mlbs beat vs their respective guidance. For KAP, this is relative to the low end of its guidance range.

Production delivered at Q1 extrapolated and annualised for 2025 vs guidance

Source: Asymmetric Research

Inkai’s production target of 8.3Mlbs for 2025 at 100%, is up 6% yoy vs 2024 despite the production shutdown at the start of the year – we think this was a positive development in that context.

Cameco inventories little changed, loans flexible as ever

In the quarter, inventory coverage of Cameco was broadly consistent vs Q4 at 5.6 months of production. As a reminder, coverage has been returning to the pre-Fukushima target of around 6 months. Loans drawn were also little changed QoQ, but Cameco increased its product loan facilities by c0.7Mlbs this quarter, which we think it will use to pay back 0.6Mlbs of material due by year end and extend the average loan maturity. It is still very cheap to borrow material and the cost of doing so hasn’t changed vs Q4 2024 despite wider credit spreads.

We will need to wait for the release of the financials of KAP to see how its coverage has evolved.

Cameco uranium loans owed, Mlbs

Source: Asymmetric Research, company reports

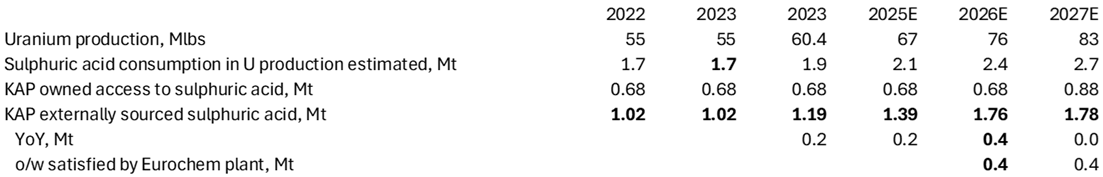

Sulphuric acid… What the market misses

Cameco was asked on its Q1 call on the status of the KAP new sulphuric acid project. Cameco argued they were not aware of the plant starting construction yet. Recall, KAP had guided to this plant coming online in 2027. We believe it could take 18-24m to build, and so, it may still come on in 2027. Worth stressing that Cameco has over the past couple of years, in our eyes at least, repeatedly underestimated KAP’s ability to deliver efficiently, yet they did and surprised (eg transport, access to sulphuric acid, restart of Inkai…).

Importantly, the market misses that KAP will get its hands on sulphuric acid in the meantime from another source. Russian fertilizer company Eurochem is building a 800kt sulphuric acid plant in Kazakhstan as part of a wider fertilizer production facility and half of that sulphuric acid plant’s production would be allocated to KAP. Press reports from late last year suggested the plant could be built end 2025.

In our view, the entry into operation of the Eurochem plant would allow Kazakhstan to ramp up uranium production to a level in 2026 that: 1) delivers on the Budenovskoye JV’s ramp up plans to c10Mlbs next year and 2) say, an additional 4Mlbs yoy production growth in 2026 vs 2025 for the remainder of the mines in country. And all this, without having to resort to additional sulphuric acid imports yoy vs 2025. If KAP’s own plant were to come online say in Q4 2027, then we think KAP can still achieve >80Mlbs production in that year. What’s more is that Kazakhstan’s capacity to import acid should further improve in any case with a resolution to the Russia/Ukraine conflict.

It needs to be stressed that the market is not expecting such ramp up at KAP materialising.

Kazakhstan uranium production and sulphuric acid

Source: Asymmetric Research, company reports

Japanese utilities – Latest on inventories and evaluating the risks

We have been arguing that both Tepco and Hokuriku were overcovered from an inventory perspective. Indications are that they have both reduced some inventories in Q1, but that was likely transferred to other Japanese utilities with net sales overall in Japan limited in Q1 to c-1Mlbs.

In our opinion, the only Japanese utility that is presently short on material is Kyushu by c5Mlbs.

In sum, we calculate the net position continues to be a 15Mlbs inventory excess in Japan with notable upside risk to that number (43Mlbs) if the following events were to materialise. These events are not part of our base case but each one of them is not improbable.

Japanese utilities excess inventory coverage now, and upside risks

Source: Asymmetric Research

Carry trade played out in spot price revival

As we had expected and described in our last notes on the sector, the carry trade has acted as a short-term catalyst in lifting the spot price from the lows over the past month and half. We believe we are now close to the point that it would have fully played out.

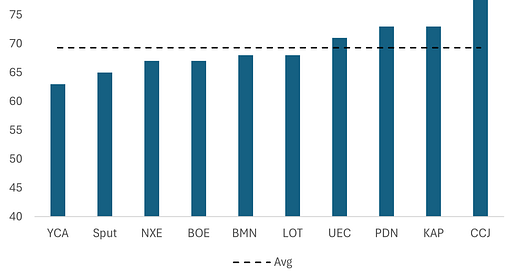

Equities valuations: Discounting $70/lb uranium

We estimate that the equities now discount on average a $70/lb uranium market price - bang in line with the spot price - with the bigger producers c$75/lb and the physical funds c$64/lb.

Uranium market price discounted in the stocks

Source: Asymmetric Research

Finally, on natural resources, we continue to prefer the gold stocks here, which we think are pricing in a conservative gold price and offer significant upside potential if the gold price holds or rises and with optionality on P/NAV multiple expansion. Please read our recent reports on the theme.