The uranium sector has rebounded hard from the lows last month, and sentiment has turned dramatically too. For some stocks, sentiment is near euphoric and warrants some caution. While many argue that utility demand is returning, the reality is that term contracting volumes have lagged aggressively year to date and missed even the most bearish of expectations.

We believe the spot price recovery came from the carry trade, as we had predicted. And this opportunity has now effectively closed, in our view.

Recent news flow has clearly been supportive nuclear, strengthening longer term fundamentals for the sector. But do they change uranium demand short term? Barring any real stoppage at Budenovskoye JV, we don’t think so. Early May an article in Kazakh press suggested this project had stalled. But that article was vague in content and not consistent in its train of thought. It is not clear whether this was new news vs what we already knew in August last year when Kazatomprom (KAP) slashed its production forecasts for the JV (we already factor in this latter point in our S&D numbers). We will know the answer to this when KAP unveils its 2026 production figures - this summer we suspect. And this data point will be key to us, since a confirmed stoppage would make us more bullish the sector. Indeed, If the project did stall, then the market should remain in deficit in 2026 (c10Mlbs on our calculations) before in our view, having the potential to balance in 2027.

But in any case and even then, we need to reiterate, that consensus has bigger supply and longer lasting deficits than we do because we think: 1) the street is and has been way too pessimistic on the outlook for an improvement in availability of sulphuric acid in central Asia, 2) Japanese utilities continue to have too ample inventory coverage and 3) in our base case, we don’t factor in utility restocking, as to our surprise in 2024, utilities managed to pull forward material in the last couple of years which means that despite the market having continued to be in deficit, utility inventories did not decline as we would have expected them to.

Regarding the Trump executive orders, yes they might be a game changer, but again we are not sure this would be a near term market balance changing phenomena. They obviously first need to be delivered on (Trump is juggling with the signing YTD of >150 executive order across wide policy areas) and critically, they would need to be delivered in a timely manner, in a sector that typically moves at snail pace. Couple of issues. First, these are executive orders, and so they can be revoked, modified, superseded with ease. We see how fast Trump changes his views, and the extent to which they can change. Also, among the executive orders last week, was the aspiration to have 10 new reactors under construction by 2030. But the next US elections are in 2028. Further, it should be reminded that new nuclear in the West has proved to take much longer to build than in the China, regulatory hurdles aside. If you say for example a c7y construction time (optimistic), and the new plant starts construction in 2028, then it is possible that utilities start only thinking of fuel supply contracts early 2030, not now.

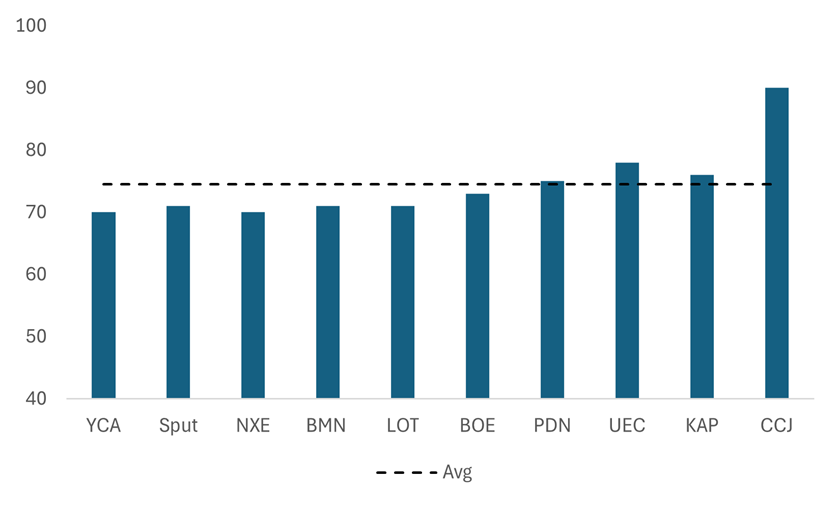

Equities now discounting $75/lb

Uranium equities are now discounting $75/lb uranium market price, after pricing $63/lb two months ago. That’s around mid-way between the spot and term prices. Term prices are broadly where the incentive price is we would argue. In addition, the valuation dispersion among stocks has generally tightened since then.

Uranium equities - Uranium market price discounted in shares (USD/lb)

Source: Asymmetric Research

As to Sput, the stock is now trading near a one standard deviation down vs history in terms of upside to NAV.

Sput upside to NAV, and uranium prices (USD/lb)

Source: Asymmetric Research

Cameco overheating?

Cameco continues to be understandably premium priced, but here, we think its valuations are getting full. On our numbers, it’s currently discounting c$90/lb uranium market price on its unhedged book, and a near 15x EBITDA multiple on Westinghouse (2026e). At the same time, it is technically overbought.

CCJ reverse sum of the parts (USDm/sh)

Source: Asymmetric Research

Landscape will look different once seawater extraction becomes real

Thanks.

Backs up my thoughts (as just a retail I hopeful) so taking profits on my tradable positions while keepingy core positions intact